- Private Equity Backed Moving Companies

- Notable Private Equity-Owned Moving Companies

- Why “Movers Near Me” is a Better Alternative

- How MoversNearMe.com Offers a Solution

Private Equity and the Moving Industry: Transforming an Essential Service

The moving industry has long been dominated by family-owned businesses and regional operators, offering a personal touch and localized expertise. However, private equity firms have recently taken a keen interest in this sector, reshaping the landscape in profound ways. This shift brings both opportunities and challenges for the industry and its customers.

Private Equity Backed Moving Companies

Private equity firms are drawn to the moving industry due to its steady demand, fragmented structure, and potential for scalability. By consolidating smaller companies under a single umbrella, private equity investors can streamline operations, reduce costs, and create efficiencies that benefit the bottom line which is what van lines have done for decades.

Both van lines and private equity-backed moving companies have faced challenges with maintaining consistent quality. Let’s explore why this has become a concern.

Notable Private Equity-Owned Moving Companies

- Allied Van Lines and North American Van Lines (owned by Sirva, Inc., backed by Madison Dearborn Partners)

- United Van Lines and Mayflower Transit (owned by UniGroup, which has attracted private equity attention in the past)

- Two Men And A Truck was acquired by ServiceMaster Brands in 2021. ServiceMaster Brands completed its acquisition of TWO MEN AND A TRUCK®/International, Inc., integrating the moving company into its portfolio of home service brands.

- All My Sons In October 2021, Golden Gate Capital partnered with Robert Peterson, the company’s founder and CEO, to recapitalize All My Sons. Peterson continues to lead the company from its headquarters in Carrollton, Texas, and remains a significant shareholder.

These companies, among others backed by private equity for regional growth, showcase how PE is reshaping the competitive landscape by injecting capital and corporate strategies into an industry traditionally dominated by smaller, independent operators.

Effects on the Industry

Consolidation

Private equity investments often lead to the consolidation of regional and independent movers into larger corporate entities. While this can provide customers with a more standardized experience, it also reduces the number of local options, potentially impacting pricing and service flexibility.

Technology Integration

Private equity firms prioritize technology adoption to enhance efficiency and customer experience. From automated booking systems to real-time tracking of shipments, these advancements improve convenience for customers but may alienate those who value a more personalized touch.

Workforce Dynamics

To maximize profitability, private equity firms often implement cost-cutting measures, which can include changes in workforce management. While this might lower operational costs, it could affect employee morale and service quality.

Customer Experience

A focus on scalability and efficiency might streamline operations, but there’s a risk that customer-centric values may take a backseat. Larger companies might lack the local expertise and personal connection that smaller businesses traditionally offer.

Opportunities for Customers

- Improved Service Options

With increased capital, private equity-backed companies can offer comprehensive services such as storage, packing, and specialized transportation, catering to a broader range of customer needs. - Competitive Pricing

The efficiencies created by larger, consolidated operations may lead to competitive pricing in some markets, benefiting cost-conscious consumers. However, these moving costs usually add 20-40% as management fees. - Advanced Technology

Customers now enjoy tools like digital inventory tracking and online quotes, streamlining the moving process and adding transparency.

Challenges for the Industry

- Loss of Local Expertise

Consolidation may lead to the erosion of local expertise and personalized services, as smaller players are absorbed into larger entities. - Pricing Volatility

While private equity may initially introduce competitive pricing, reduced competition could eventually lead to price increases. - Service Quality Concerns

The drive for profitability might compromise the high-quality service standards customers expect, especially in complex or high-stakes moves.

The Future of Moving: Balancing Growth and Service

The private equity influx is poised to bring modernization and growth to the moving industry, but it also raises questions about preserving the personalized touch that has historically defined the sector. For customers, the key will be to navigate these changes by researching their options carefully, ensuring that their chosen moving company aligns with their values and needs.

Why “Movers Near Me” is a Better Alternative

Amid the challenges faced by both van lines and private equity-backed moving companies, MoversNearMe.com stands out as an innovative solution for maintaining excellent service while empowering moving companies to retain more of their hard-earned profits.

The Problem with Traditional Van Lines and Private Equity

Van lines and private equity-backed companies often operate on a revenue-sharing model, where local moving companies must forfeit 20-40% of their profits. While this system provides branding, resources, and operational support, it comes at a significant cost. Additionally, the focus on corporate efficiency can sometimes overshadow the personalized service that customers value most.

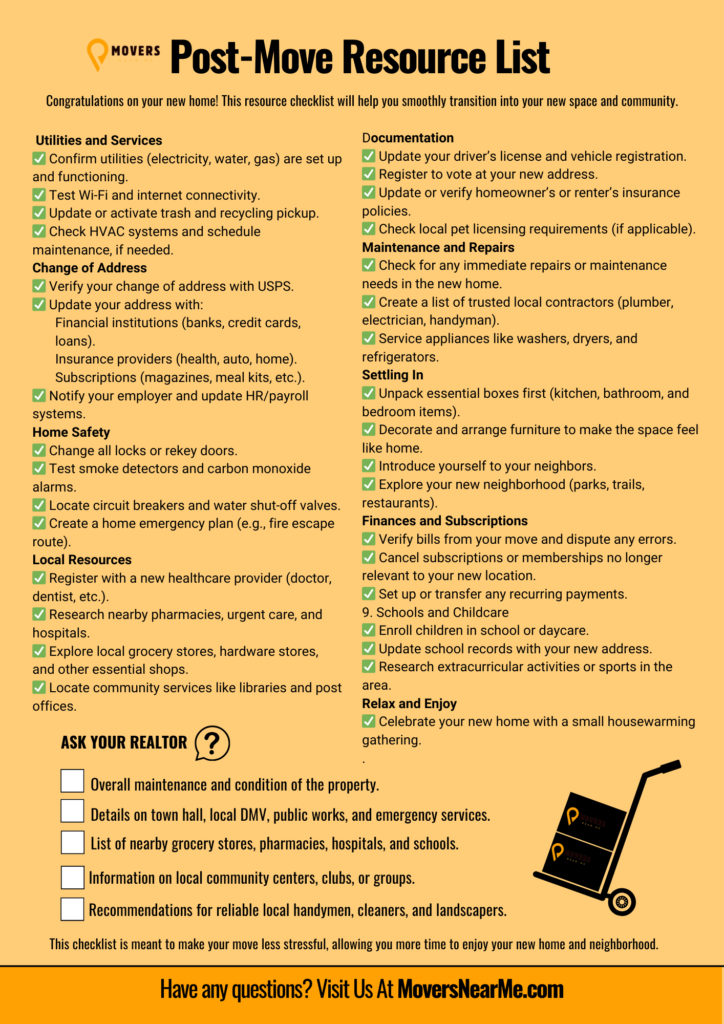

How MoversNearMe.com Offers a Solution

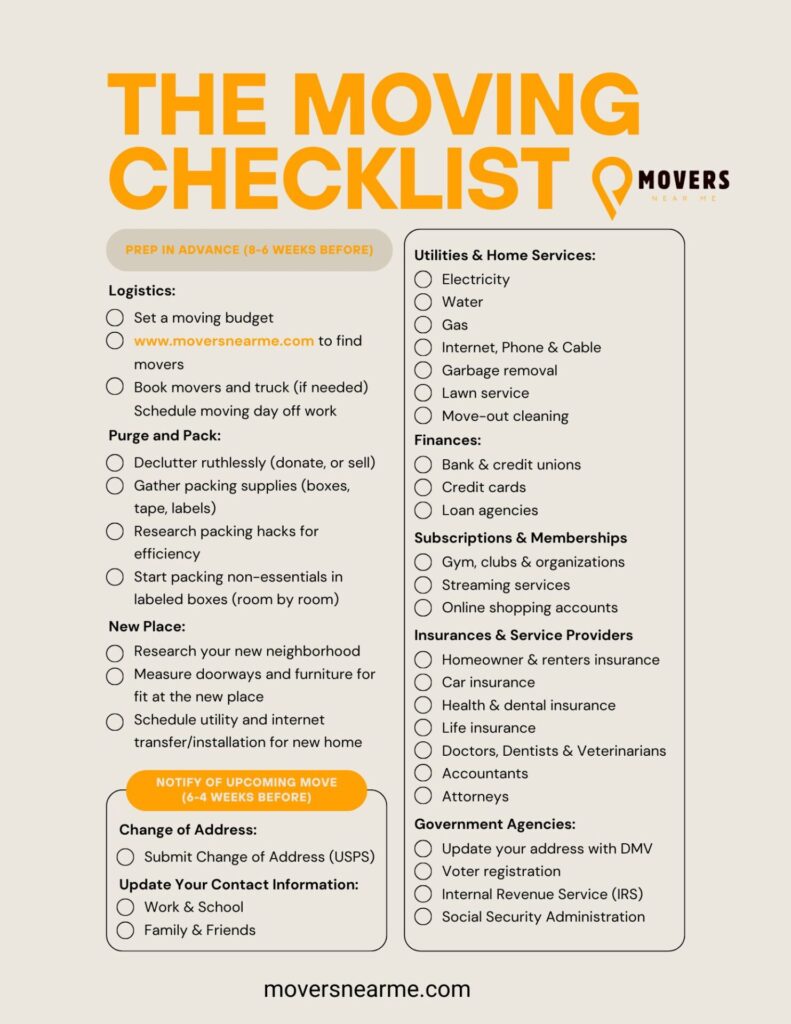

Movers Near Me is a platform designed to connect customers directly with reputable, independent moving companies, bypassing the traditional van line or corporate model. We are currently working on an app and a master list that is automated based on realtime factual data, customer experience and expertise. Here’s why it’s a game-changer:

- Lower Costs for Movers

By avoiding the revenue-sharing agreements with van lines and private equity firms, independent moving companies can retain 100% of their profits. This allows them to invest directly in their business, whether it’s hiring skilled staff, upgrading equipment, or enhancing customer service. - Focus on Quality and Local Expertise

Movers listed on MoversNearMe.com can maintain their local expertise and personalized service without the constraints of corporate policies. This ensures a higher level of attention to detail and customer satisfaction. - Transparency for Customers

The platform prioritizes transparency by offering upfront pricing and verified reviews. Customers can choose movers based on reputation and reliability rather than brand recognition alone. - Empowering Small Businesses

Supporting independent movers through platforms like MoversNearMe.com helps strengthen local economies and encourages the growth of small businesses.

A Win-Win for Customers and Movers

For customers, Movers Near Me provides access to a curated list of reliable movers who are incentivized to deliver excellent service without being burdened by costly corporate overhead. For moving companies, it’s a chance to compete on a level playing field, retain more revenue, and focus on what truly matters—delivering exceptional moving experiences.

By choosing Movers Near Me, customers and movers alike can benefit from a system that prioritizes quality, fairness, and local expertise, addressing the challenges that have historically plagued both van lines and private equity-backed companies.